To be a member of the self-employed category, a candidate must have a minimum of two years of experience in cultural activities, sports or the purchase and management of a farm (for applications received before March 10, 2018), at during the period beginning five years before the date of the permanent resident visa application and ending on the day a decision is made on the application.

The experience may consist of either two one-year periods of independent work experience in cultural activities, two one-year periods of participation in world-class cultural activities, or a combination of one-year periods. year in both.

Experience may also consist of either two one-year periods of independent work experience in athletics, two one-year periods of experience participating at a world level of athletics, or in a combination of one-year periods in both.

What is self-employment?

The Self-Employed Category section of the Immigration, Refugees and Citizenship Canada website does not describe what self-employment is.

However, the Canadian Experience Category section of the website provides the following:

Determining an applicant’s employment status

CEC applicants must satisfy a CIC officer that they meet all program requirements (R87.1). Any period of self-employment must not be included in the calculation of the period of qualifying work experience under the CEC (R87.1(3)(b)). As such, the CEC requires applicants to demonstrate that they have acquired qualified work experience in Canada through employment authorized by a third party.

As per the CEC Document Checklist, principal applicants are requested to provide documentary evidence of their work experience in Canada by combining: a copy of their most recent work permit (unless they are exempt from work permits), copies of their most recent work permit. recent T4 tax information slips and a notice of assessment (NOA) issued by the Canada Revenue Agency (CRA) or a sufficient combination of other supporting documents and employer reference letters for all periods of eligible work experience claimed in the application.

Canadian employers are responsible for deducting and remitting to the CRA Canada Pension Plan (CPP) premiums, Employment Insurance (EI) premiums and income tax on remuneration or other amounts they pay to their employees. They must also provide employees with a record of their remuneration and deductions in the form of a T4 tax information slip. The T4 slip therefore constitutes key documentary evidence for the vast majority of CEC candidates demonstrating that they were in an employer-employee work relationship during their period of eligible work experience in Canada.

However, the regulations do not require CEC applicants to provide a T4 tax information slip or an ADC specifically with their application, and these particular documents cannot be considered conclusive evidence or the only evidence accepted in determining whether an applicant owns qualifying Canadian securities. professional experience. Therefore, in the absence of a T4 tax information slip or a NOC, documents that can help substantiate the applicant’s work experience in Canada could include a statement or letter of employment from the Canadian employer, employment contracts and pay slips.

In all cases, it is the applicant’s responsibility to establish that they meet the CEC program criteria at the time of their application. All applicants must provide satisfactory evidence of their work experience in Canada, including that they were in an employer-employee relationship during their period of qualifying work experience.

Factors to consider – employed or self-employed

To determine whether an applicant under the CEC was an employee or self-employed during their period of eligible work experience in Canada, CIC officers should consider factors such as:

-

- the worker’s degree of control or autonomy over how and when the work is performed, as well as the method(s) used to perform the work;

- whether the worker owns and/or provides tools and equipment to perform the work;

- the extent to which the worker must carry out the work personally and whether they have the option of subcontracting the work or hiring others to help them complete the work;

- the degree of financial risk assumed by the worker, including whether the worker is required to make an investment to complete the work or provide the service and whether the worker is free to make business decisions that affect his or her ability to make a profit or suffer a loss (as opposed to the opportunity to earn commissions or other productivity bonuses); And

- any other relevant factors, such as written contracts.

Additional details regarding each of the above factors and indicators that can be used to determine whether an individual is an employee or self-employed can be found in the Employed or Self-Employed? ARC Guide.

It can be difficult to determine the degree of control when examining the employment of professionals such as engineers, doctors and information technology consultants. Given their expertise and specialized training, they may need little or no specific direction in their daily activities. When considering the control factor, it is necessary to focus on both the payer’s control over the worker’s daily activities and the payer’s influence over the worker. There are also certain occupations in which individuals may either be self-employed or have an employer-employee relationship depending on the specific circumstances of their employment. More information on determining a worker’s employment status for a number of specific job categories is available on the CRA website.

Generally speaking, consultants/contractors are considered independent workers in a “service contract” type commercial relationship. For example, independent contractors in the finance, real estate and business services industries. Similarly, individuals who hold a significant stake and/or exercise management control over a company for which they also work are generally considered self-employed.

If a potential applicant is unsure of their employment status and does not have the documentation described above, they may choose to request a ruling from the CRA to have that status determined. Such a decision will indicate whether, in the opinion of the CRA, a worker is an employee or self-employed and whether that worker’s employment is pensionable or insurable. A worker can request a decision by sending a letter or the duly completed form CPT1, Request for a Decision Concerning the Status of a Worker Under the Canada Pension Plan and/or the Employment Insurance Act, to their tax services office. This decision may subsequently be submitted to CIC to complete a request from the CEC.

Each application made under the CEC must be considered on its own merits, with the final decision based on a review of all information available to the CIC officer at the time of the decision. Although a CRA decision on an applicant’s employment status will be given due consideration by a CIC officer, such a decision will not constitute conclusive evidence. The final decision regarding the applicant’s employment status for purposes of meeting CEC requirements rests with the CIC officer.

Case law

Pursuant to the decision of the Federal Court of Canada in Zhang v. Canada (Citizenship and Immigration), the absence of an employment contract does not mean that someone was self-employed. As Madam Justice Walker stated:

The plaintiff contends that because he does not have a written employment contract with the athletic school, the agent erred in concluding that he was a salaried employee. However, the fact that a person does not have an employment contract with an employer but rather works under contract is not determinative of whether he or she is an employee or independent contractor. Many people work under short- or long-term contracts but are nonetheless employees. It is necessary in each case to consider the structure of the relationship between the individual and the entity to which he provides services.

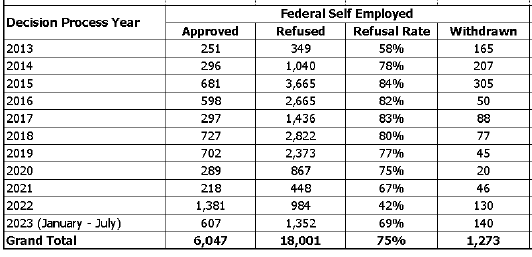

Statistics