Oct 3 (Reuters) – The global cryptocurrency market remains severely scarred after the tumultuous collapse of crypto exchange FTX and other big players last year, with prices, volumes and capital investment falling -risk well below their 2021 highs.

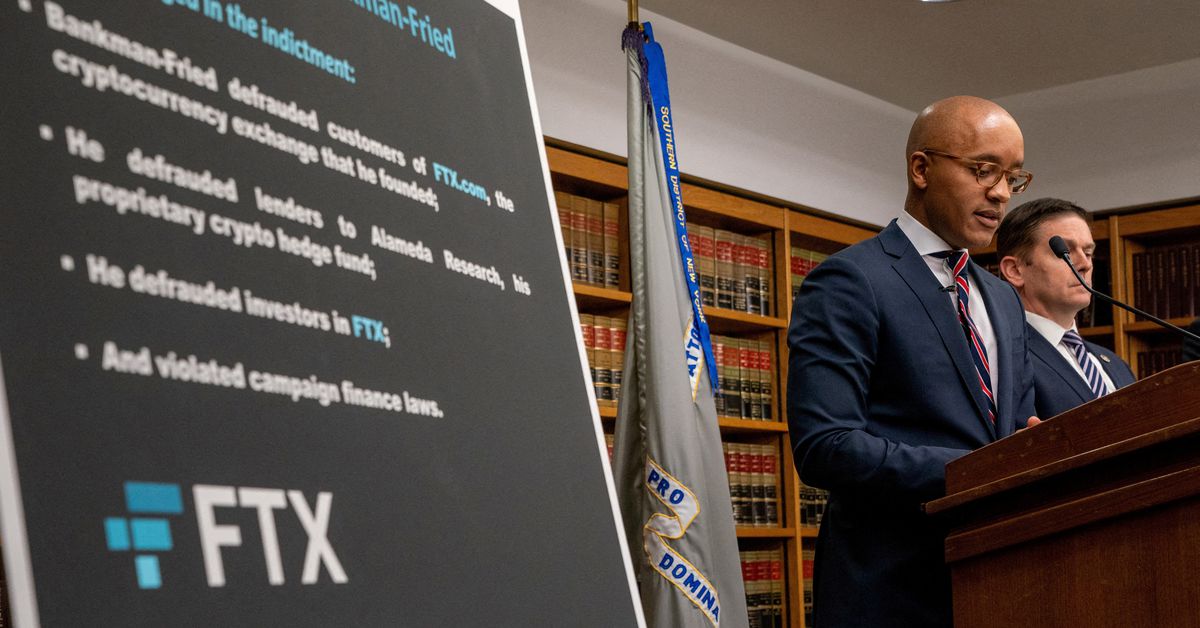

Sam Bankman-Friedthe former CEO of FTX, is on trial Tuesday in New York, charged with seven counts of fraud and conspiracy stemming from the brutal collapse of the stock market in November 2022. He pleaded not guilty.

FTX is part of a series of industry collapses that sent bitcoin to its lowest price since 2020. Although bitcoin and other major tokens have partially recovered, the sector remains far from the peak of fever which he reached at the end of 2021.

Here are five charts that show how the crypto landscape has changed.

THE BLUE OF BITCOIN

Bitcoin, by far the largest cryptocurrency and the leading barometer of crypto market sentiment, has rebounded about 37% since November 1.

Cryptocurrency was on the rise in 2021, reaching a record $69,000 in November of the same year. But when central banks began raising rates in early 2022, riskier assets like cryptocurrencies began to struggle as investors sought better returns elsewhere.

Bitcoin lost more than 65% of its value last year, hit by the collapse of the terraUSD stablecoin, which led Singapore hedge fund Three Arrows Capital to file for bankruptcy and wreaked greater havoc on crypto markets.

Several other companies also collapsed, but the fall in FTX pushed bitcoin below $16,000 in November last year. Bitcoin took another hit earlier this year when Silvergate Bank, a popular US partner for crypto companies, declared it. would stop.

Yet bitcoin has regained nearly three-quarters of its value this year thanks to interest from major financial firms, including BlackRock, and hopes that interest rate hikes will end. It was trading at around $28,089 on Monday.

“The FTX debacle came at the end of a horrible year that had already seen a collapse of the tech sector, sharply rising interest rates and self-inflicted wounds to the industry,” said Ben Laidler, Global Markets Strategist at eToro.

Image Reuters Acquire license rights

A crumbling market capitalization

After peaking at $3 trillion in November 2021, the value of the overall crypto market collapsed through 2022, hitting a two-year low of $796 billion as FTX imploded. It has since regained ground, hovering above $1 trillion for most of this year.

“The issues with FTX have undoubtedly shaken confidence in the crypto ecosystem as a whole,” said Usman Ahmad, CEO of Zodia Markets, the crypto exchange of global bank Standard Chartered. (STAN.L).

Image Reuters Acquire license rights

STABILIZE BITCOIN?

Known for its volatility, bitcoin has gained some stability this year.

Still, the relative calm in cryptocurrency markets is not necessarily a good thing, some market participants said, pointing out that many investors are attracted to cryptocurrencies precisely because of their volatility, which offers opportunities to make profits. quick profits.

“We expect low to medium volatility in the short term,” said Anders Kvamme Jensen, founder of crypto firm AKJ.

VC CRYPTO BET TUMBLE

Venture capital (VC) investments flocked to crypto during its boom year of 2021, and even into 2022. But those bets have slowed significantly this year, after many companies were burned by the market collapse.

US crypto VC investments totaled $6.12 billion in the first quarter of 2022, but fell to just $870 million in the same quarter this year, according to data firm PitchBook.

“This slowdown was not primarily due to the failure of FTX but was already underway with the collapse of the (terraUSD) ecosystem earlier in the year,” said Robert Le, senior crypto analyst at Pitchbook.

“Venture capitalists are now moving cautiously,” he added.

Image Reuters Acquire license rights

DISAPPEARING VOLUMES

Since FTX’s failure, crypto trading volumes have collapsed, forcing traders attracted by the market’s high liquidity to suspend buying and selling tokens or even exit the market altogether.

In September 2023, total monthly volumes in spot and derivatives markets fell to $1.4 trillion, a decline of more than 60% from September 2022, according to London-based researcher CCData. Spot markets were hardest hit, with volumes down more than 70%, to $272 billion.

Derivatives volumes, meanwhile, fell 60% to $1.1 trillion in the 12 months since September 2022.

“The exit of some large market makers after FTX significantly reduced liquidity, leading to low trading volumes and low volatility,” said Noelle Acheson, an economist who closely follows crypto.

Image Reuters Acquire license rights

Reporting by Hannah Lang in Washington and Elizabeth Howcroft in London; Additional reporting by Tom Wilson in London; Editing by Michelle Price and Andrea Ricci

Our standards: The Thomson Reuters Trust Principles.